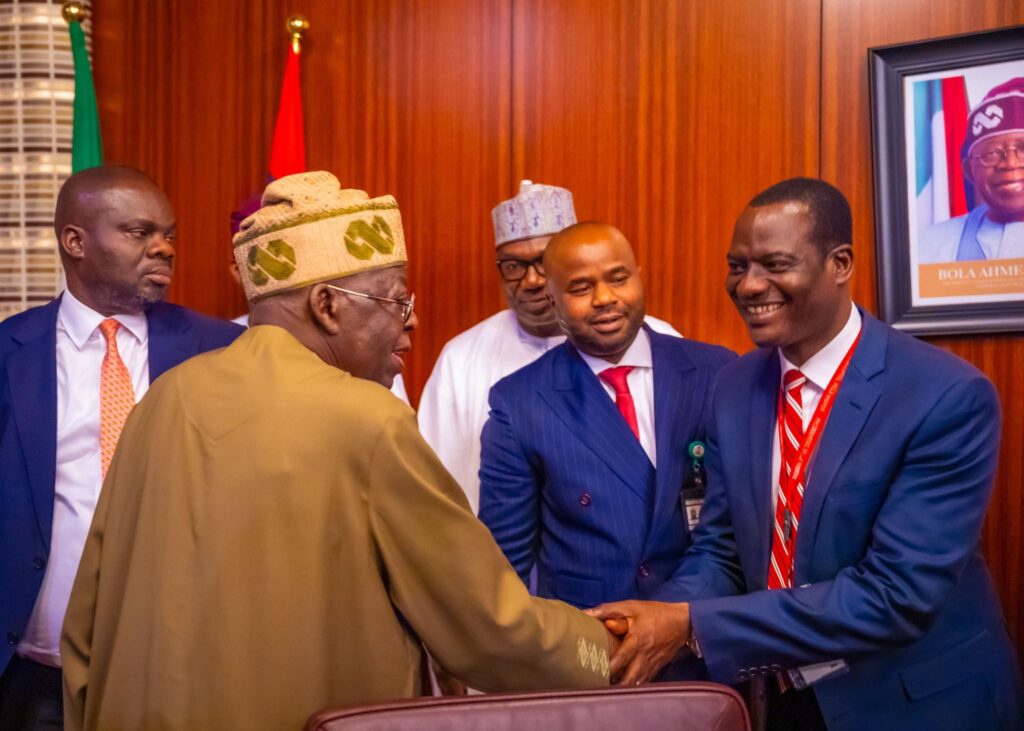

In a significant move aimed at reshaping Nigeria’s fiscal architecture and improving revenue generation across all tiers of government, President Bola Ahmed Tinubu has signed the long-anticipated Tax Reform Bills into law. The sweeping reforms are designed to simplify tax administration, enhance state autonomy, and offer relief to low-income earners and small businesses.

The signing of the bill marks a turning point in the nation’s journey toward a more equitable and efficient tax system.

National-Level Reforms Affecting All Nigerians:

- FIRS Transforms into NRS:

The Federal Inland Revenue Service (FIRS) is now officially renamed the Nigeria Revenue Service (NRS) and will assume broader revenue collection responsibilities from agencies like the Nigeria Customs Service, NUPRC, NPA, and NIMASA. - Income Tax Relief for Low-Income Earners:

Workers earning ₦800,000 or less annually will now enjoy full income tax exemption. - High-Income Earners Taxed More:

A 25% personal income tax rate now applies to individuals earning over ₦50 million per annum. - Small Business Relief:

Small businesses are fully exempted from paying income tax, easing the burden on micro-enterprises and startups. - Reduced Company Income Tax:

Beginning in 2026, medium and large-scale companies will enjoy a reduced company income tax rate of 25%, down from 30%. - VAT Exemptions on Essentials:

The reform maintains VAT at 7.5% but exempts basic goods and services—such as food, medical care, school fees, pharmaceuticals, and electricity consumed by the poor. - No Increase in Corporate Tax or VAT Rates:

Corporate Income Tax remains at 30% for large corporations, with no increment in rates, offering policy stability to businesses. - Development Levy Introduced:

A new Development Levy ranging from 2% to 4% has been created to fund national education, innovation, and development agencies including NELFUND, TETFund, NITDA, and NASENI.

Key Highlights of the New Tax Reform:

For Subnational Governments (States):

1. 5% VAT Revenue to States:

The Federal Government will now cede an additional 5% of Value Added Tax (VAT) revenue to state governments, boosting their internal revenue capabilities.

2. Electronic Money Transfer Levy:

Income from this levy, previously shared, will now be transferred exclusively to states as part of stamp duties.

3. Updated Stamp Duties Act:

The obsolete Stamp Duties Act will be repealed and replaced with a simplified version to enhance state-level revenue collection.

4. Limited Liability Partnerships Tax:

States will now be entitled to tax revenues from Limited Liability Partnerships (LLPs).

5. Tax-Free State Bonds:

State government bonds will now receive the same tax-exempt status as federal government bonds, attracting more investors.

6. VAT Distribution Overhaul:

A more equitable VAT attribution and distribution model will be introduced to reflect true consumption patterns.

7. Integrated Tax Administration:

States will benefit from enhanced tax intelligence, capacity building, and an expanded Tax Appeal Tribunal to handle state tax disputes.

8. Enforcement Powers:

The Accountant General of the Federation (AGF) will now have powers to deduct unremitted taxes from MDAs and transfer them to the appropriate beneficiary.

9. Autonomous State Revenue Services:

A framework will support greater autonomy for state Internal Revenue Services and strengthen the Joint Revenue Board.

10. Lottery and Gaming Taxation:

A legal framework for taxing gaming and lottery activities has been introduced, alongside new withholding tax structures.